Metis Asset Management

MAM will take you through a detailed risk analysis and build a portfolio to help match your tolerance for risk and capacity for loss. This can incorporate both active and passive fund management solutions to enable us to control cost within your account.

Our Investment Approach

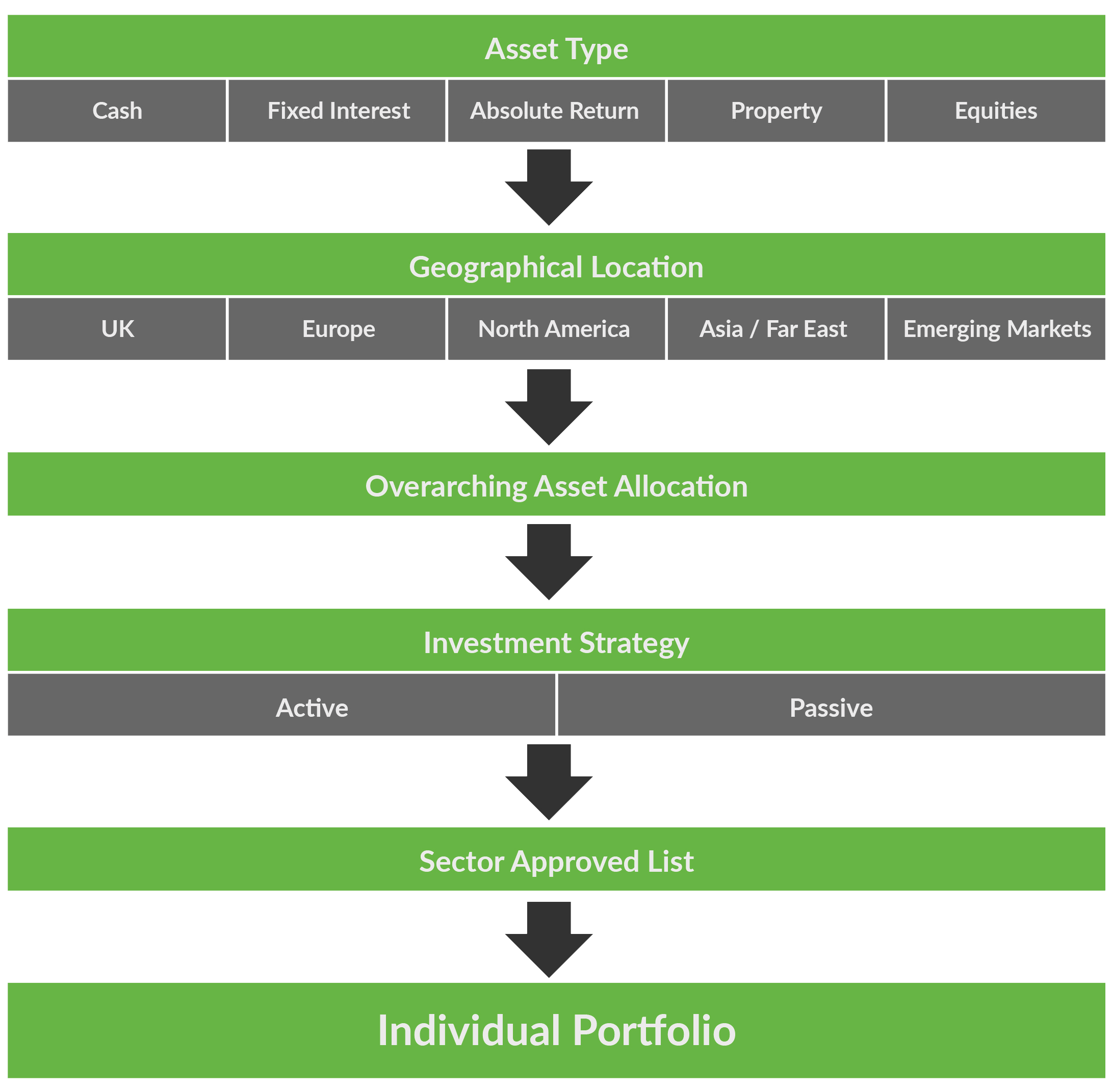

In constructing any portfolio we make use of assets from across the risk spectrum including cash, fixed interest, alternatives (absolute return), property and equities.

These asset classes have different risk and return characteristics and by blending them together we will create a portfolio that aims to meet your investment requirements.

The Metis Asset Management investment committee meets at least quarterly to discuss underlying investment strategies and the ways in which we believe we can add value for our clients. We will also call special meetings in reaction to significant market events to agree our strategy. As a fundamental part of our investment process revolves around diversification, at the present time we are solely utilising collective investment vehicles (unit trusts and open ended investment companies).

We look to incorporate strong managers in their fields, with strong track records and superior risk-adjusted returns. In conjunction with the traditional asset classes of cash, fixed interest and equities we may also look to invest in absolute return funds as we feel portfolios can benefit from exposure to asset classes which are less correlated to equity markets. These provide further diversification and can provide an element of downside protection, enhancing risk adjusted returns, particularly during periods of bond and equity market volatility.

Our Process

Our investment process is tailored to create above average risk-adjusted returns for our clients. We seek to add value by identifying compelling investment opportunities and constructing diversified portfolios within the agreed risk parameters.

We combine a top-down strategy for the overarching asset allocation and a bottom-up strategy to provide the appropriate investments to populate clients’ portfolios.

At outset, our Investment Committee establishes the asset allocation by deciding how much to allocate to each asset class, a top-down approach. By diversifying investments between different asset classes, we seek to achieve an appropriate balance between the risk and return.

Once the asset allocation of a portfolio has been determined, the bottom-up component of our investment process seeks to determine which individual investments are to be incorporated into our portfolios. This part of our process is again driven by the Investment Committee who pool together their considerable knowledge and experience to formulate our “approved list” of investments.

Metis Asset Management are fully independent which ensures we are unconstrained in the way we construct and manage a portfolio. We select the best investments available for portfolios based on the independent investment process highlighted above.